[Please refer to the disclaimer section before taking any decisions on the basis of this article]

What is an invoice or bill?

An invoice or bill is a document that outlines the details of a transaction between a seller and a buyer. It includes information such as the products or services provided, the quantity, the price, any applicable taxes or fees, and the total amount due. Invoicing is a crucial part of any business, as it helps to keep track of sales, manage cash flow, and ensure timely payments. Understanding the basics of invoicing is essential for both businesses and individuals, as it can help to prevent misunderstandings and disputes. This blog will provide a comprehensive overview of invoices and bills, including their purpose, different types, and best practices for creating and managing them.

|

| Note 1 |

Invoices types to issue in Nepal and their Enforcing legislations:

1. PAN Bill

A person conducting business who is not registered for Value Added Tax (VAT) needs to issue such bills.

Enforcing Legislation : Income Tax Regulations, 2059; Rule 23(4)

Legal Wording : Taxpayer conducting business after obtaining Permanent Account Number shall issue an invoice in sequential series of numbers mentioning name of taxpayer, address and the PAN.

Format : Not specified.

2. Tax Invoice

It is to be issued by a person registered in Value Added Tax (VAT). It is commonly referred to as VAT Bills in common tongue.

Enforcing Legislation : Value Added Tax Act, 2052; Section 14

Legal Wording :

- 17(1): Unless and until tax officer approves, if a registered person procures goods or service, then the receiver shall be provided with Tax Invoice as mentioned in Anusuchi 5 and Anusuchi 5A and shall disclose the type, size, model and brand(if any) of the commodity.

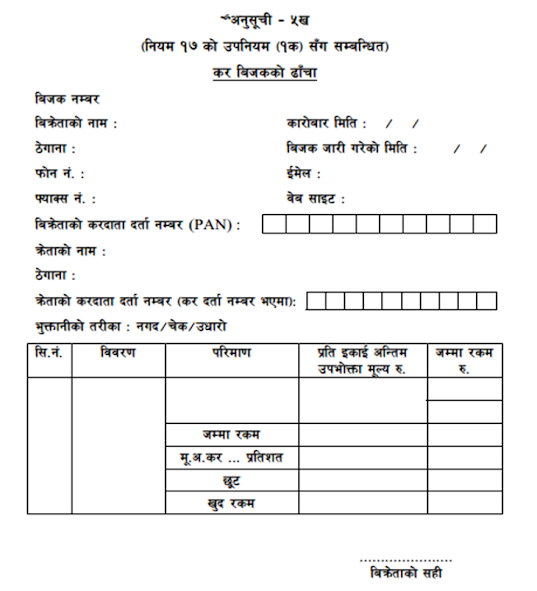

- 17(1A): Notwithstanding anything contained in Rule 17(1), while selling goods or services as per Section 14(6), then Tax Invoice in format as provided in Anusuchi 5B. [Consumer level VAT, separate mini-article to be written soon]

- 17(2): The invoice shall explicitly express "Tax Invoice" in the face page of invoice. This invoice shall be prepared in triplicates.

- Original Copy: Provide to the customer

- Second Copy: Maintain as to provide to tax officer whenever he/she requires

- Third Copy: Maintain for the purpose of the person self

- Anusuchi 5 & 5A for 17(1)

- Anusuchi 5B for 17(1A)

|

| Anusuchi 5 Format - Normal Tax Invoice |

|

| Anusuchi 5A Format for Non-Life Insurer |

|

| Anusuchi 5B Format - Consumer Level VAT |

3. Abbreviated Tax Invoice (A.T.I.)

It is to be issued by a person registered for VAT only after approval from the Inland Revenue Department (IRD). It can be issued only for upto Rs. 10,000 (inclusive of VAT) at a time. If a customer demands for the Tax Invoice, then the seller is obliged to provide him/her a Tax Invoice.

Enforcing Legislation : Value Added Tax Regulations, 2053; Rule 18(1)

Legal Wording : Notwithstanding anything contained in Rule 17, if a registered person selling goods in retail requests tax officer disclosing the issue as above of retail selling, then the tax officer may give the person the permission to issue A.T.I. as mentioned in Anusuchi-6 instead of Tax Invoice. This can be issued only upto the amount of Rs 10,000. But, a Tax Invoice has to be issued if the customer demands for the same regardless of the amount of the bill.

Format : Anusuchi 6

|

| Anusuchi 6 Format - Abbreviated Tax Invoice |

4. Excise Invoice

It is to be issued by a person manufacturing excisable goods or services. This means the person needs to be registered with the Inland Revenue Department as an excisable goods or service producer. It is just a tax invoice which incorporates excise duty in it before calculation of VAT.

Enforcing Legislation : Excise Regulations, 2059

Legal Wording :

- Rule 6(4): Excise duty to be collected from Tax Invoice of format as in Anusuchi 13 for goods or service to be issued in Self Removal System and deposit as per section 3.

- Rule 6(5): After the Demand Form to issue goods under Physical Control System is approved, goods are to be issued by issuing Invoice as in Anusuchi 13

- Rule 29A: Tax Invoice to be issued in format of Anusuchi 13 while selling service as mentioned in section 3(1) of the act.

Format : Anusuchi 13

|

| Anusuchi 13 Format - Tax Invoice for Excise |

What You should Remember:

- To be noted that the laws have provided invoices formats in Nepali language as the laws are drafted and passed in Nepali language

- The words "Anusuchi" (Nepali) mentioned in this article means "schedule" (English) and the schedules of formats mentioned in the articles are of the respective legislations mentioned in the "Enforcing Legislation" section of each type of invoice

- All the date used in this article are in Bikram Sambat (B.S.), the national calendar used in Nepal which is about 56.7 years ahead of the Gregorian calendar system

- Note 1 : Source of image is: https://www.pngitem.com/middle/iJRiRwb_that-s-my-billing-invoice-icon-invoice-icon/